- Accueil

- portfolio 900

- Portfolio trading breaks into new markets - The DESK - The leading source of information for bond traders

Portfolio trading breaks into new markets - The DESK - The leading source of information for bond traders

4.5 (190) · € 20.50 · En Stock

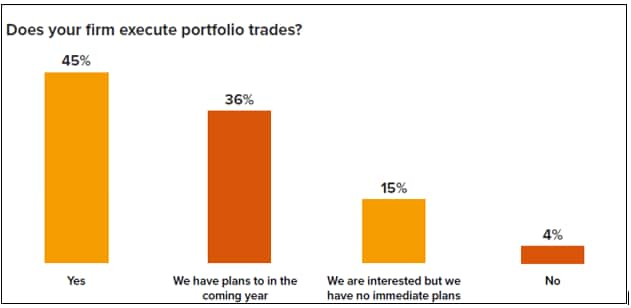

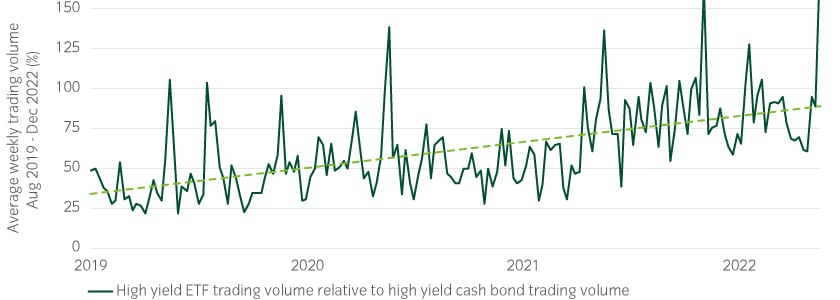

Emerging markets are adopting PT to add efficiency to liquidity sourcing, writes Matt Walters of MarketAxess. Portfolio trading has seen a lot of success and now it is expanding into emerging markets as part of its continued growth. Traders across the buy- and sell-side are finding new applications and situations in which it can be highly effective. TRACE data in the US indicates that portfolio trading volumes increased by US$100 billion in 2022 versus 2021. That was led by taking activity from voice trading. The growth of our own Portfolio Trading volume has also been rapid - in 2022 we

:max_bytes(150000):strip_icc()/DDM_INV_sector-breakdown-Final-770a19a484cd494a80b7cd9d5dd0e683.jpg)

Sector Breakdown: What It Is and How It's Used

The Portfolio Trading Paradigm Shift: What's Driving the Intrigue

How portfolio trading is transforming the bond markets

Bond portfolio trades are cheap as chips. Why?

The promise of AI in corporate bond trading

/cloudfront-us-east-2.images.arcpublishing.com/reuters/CIETXDQIAJM2RNQLNBHQOFIF4E.jpg)

ETF debuts set to break 2021 record as active-fund issues jump

Introduction to the thinkorswim® Desktop Platform

Bond markets are being hit hard — and it's likely to impact you : NPR

Most Important Bond Market Needs Fixing Before It's Too Late

Bond Traders' Fury After Jobs Report Tests Market's Boundaries

Credit Insights: Credit portfolio trading explained